Reports! Where are the Reports?!

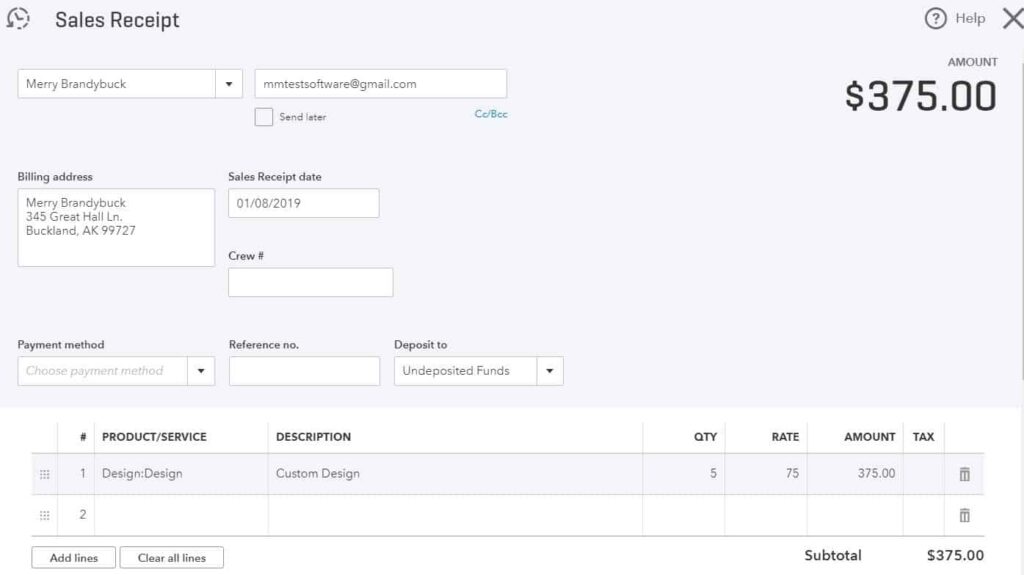

So, you or your bookkeeper have been diligently recording your transactions all month. Everything is in there. What now?

Remember that one of the main reasons we engage in bookkeeping at all is so that we can generate reports to assist in managerial decision making. This is because looking at an individual transaction only tells you about that specific transaction and looking at the whole data set won’t show you anything other than how busy your bookkeeper is.

By generating specific reports we can use the accounting platform or software to filter, categorize and display information in ways that are insightful and useful.

Let’s look at a few common report types that would be useful for a business owner or manager.

Pro Forma Financial Statements

Balance Sheet/Statement of Financial Position

This report will display the balances in your company’s asset, liability and equity accounts as of a particular date. Any transactions dated on or before that date will be included but anything posted with a date after the report date will not. In this way it is a “snapshot” of where the company was financially on that particular day. This is useful for computing various ratios which can communicate the financial health of the business, such as liquidity and solvency.

Income Statement/Statement of Profit & Loss

The income statement displays a business’s revenues (sales), expenses, gain and losses over a given period. It is prepared on an accrual-basis, meaning that transactions are displayed when they are dated (or occurred) rather than when cash was collected or paid out. When the expenses are accurately matched to the revenues that they generated the income statement is prepared correctly and shows us the level of profitability (or unprofitability) a business achieved over a given time period (month, quarter, year, etc.).

Account Reports

For any given account on either the balance sheet or the income statement you can click on the balance to open a report of all of the transactions posted to that individual account. This can be useful for understanding specific accounts and drilling down on surprising balances or results to detect underlying problems, successes or *gasp*…bookkeeping errors!

Aging Reports

Aging reports show how long it has been since a specific transaction date (or due date) by comparing today’s date to that date and categorizing the transactions based on their age. The most commonly used aging reports are the Accounts Receivable Aging Report and the Accounts Payable Aging Report.

Receivables

Groups open (uncollected) invoices in 30 day (roughly monthly) periods based on how long it has been since they are due. The longer a receivable goes after its due date without being collected, the less likely it is that it will be collected at all. The A/R aging report can identify invoices that are in danger of not being collected as well as those that are unlikely to ever be collected. This will tell you where to focus your collection efforts.

Payables

By knowing how long it has been since your bills were due, or if they are not yet due you can effectively manager your cash flow. This report will show you which bills are overdue which can identify which suppliers may be close to cutting off service or taking other collection actions.

Sales by Customer

This is a useful report for determining your best customers. Pareto Analysis or the “80/20 Rule” often shows that 20% of a given data set produces 80% of occurrences. For example, 20% of a business’s customers often produce 80% of their revenue, while another 20% often produce 80% of the headaches. Keep an eye on which customers are key to your success and make sure you keep them happy!

Expenses by Vendor

Like the sales by customer report, this report shows you where most of your expense dollars are going. This can help you identify key supplier relationships to protect and enhance. It may even help you identify areas where you may have some leverage to negotiate discounts or other preferential terms.

Comprehensive Reports

While the previous report types show us specific data there are times where you, your accountant or financial analyst may want to see “everything.” These reports can be generated in a number of ways and are useful for higher level analytics in exported CSV format to be analyzed in programs like Excel, Power BI or Tableau.

Transaction List by Date

Every transaction in a given period listed chronologically.

Audit Log

Every transaction in a given period including details about its creation, subsequent edits, voiding or deletion. These details usually include which user altered the transactions, on which date and at what time.

General Ledger

Each account on the balance sheet and income statement with every transaction adjusting its balance listed underneath it (each transaction will be in at least 2 places. Double-entry bookkeeping, remember?).

Journal

This report will include all transactions that were entered via Journal Entry rather than through an entry screen (bill entry screen, sales receipt entry screen, etc.).

Trial Balance

The balance in each account of the balance sheet and income statement as of a specific date. Accounts with a debit balance are shown in one column while accounts with a credit balance are shown in another.

Other Things to Remember

Dates

Always check the date settings on your report after you run it. Many platforms have a default date range which the report will reset to, especially after a new transaction is entered.

Remember that the shorter your time frame the more impact each transaction has, which can make ratios and percentages go out of whack. Daily or weekly reports will often be too erratic to be useful, unless you have a realistic benchmark expectation already.

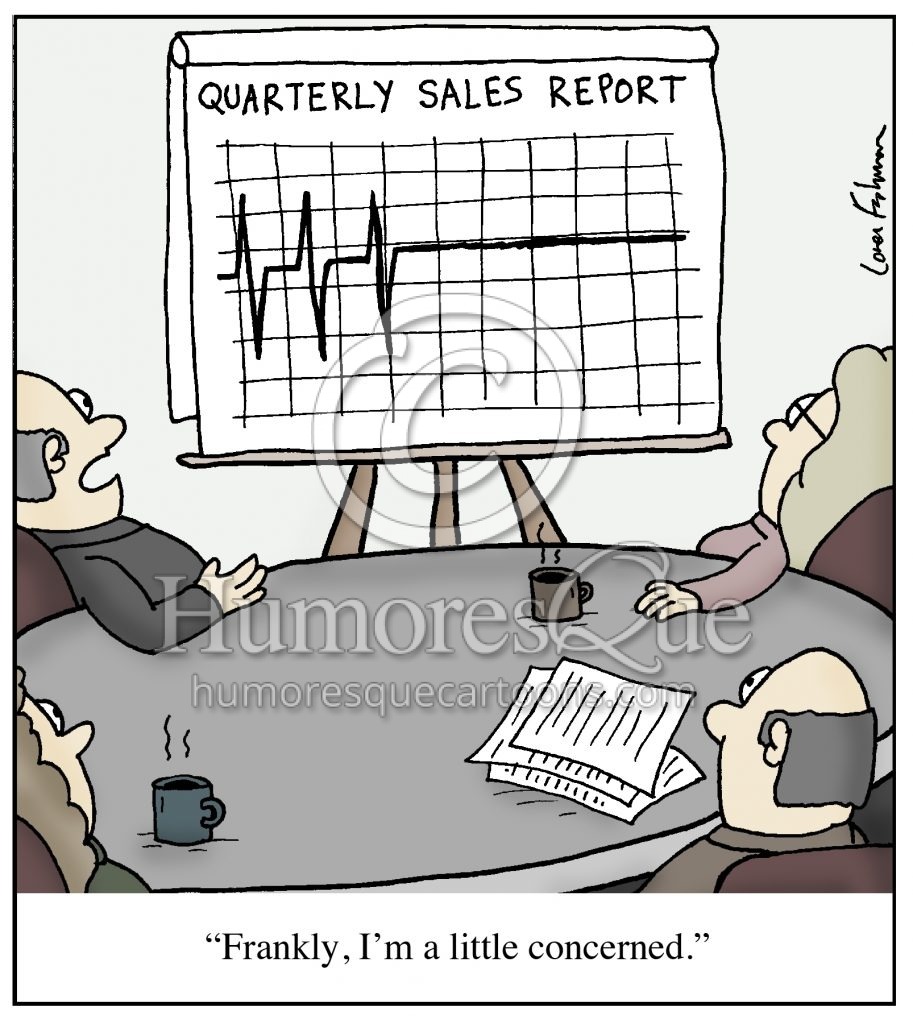

Comparisons

Most reports can be formatted to include additional columns, such as a comparison to the previous period or year. With the previous period comparison the accounting program will show you the balance for the same account after subtracting the same number of days in your report from the start and end dates (ex. an Aug. report would start on Aug. 1 and end Aug 31; a previous period comparison would subtract 31 days from the end and start dates to use July 1 and 31 as the comparison period). Most platforms are able to automatically adjust once they recognize a “monthly” or “quarterly” report but be careful if you are using an irregular period as the program will only subtract the same number of days.

Previous year comparisons are simpler; they will just show the same amounts from the period that occurred one year prior.

These automated comparisons are often useful for showing how performance and financial position have changed over time.

Filters

Most reports can be filtered to show only some of the data contained in the data set. The most common filter is the “name” filter, which will allow you to see the data pertaining only to specific customers or suppliers.

Ensuring that your bookkeeping is accurate will mean that you can actually use these automated reports to assess the performance and health of your business. These “stock” reports also serve as the best starting point for customizing your business’s reports to show you exactly what you need to know to make effective managerial decisions.

On the flip side unreliable data will produce unreliable reports. Garbage in, garbage out. If you need those reliable reports on a regular basis then consider Toronto Bookkeeping Plus for your outsourced bookkeeping, payroll or training needs.

Next Topic: The Bookkeeping Cycle