What do Quickbooks, Xero, Wave and all other off-the-shelf accounting software packages have in common with coded-from-scratch, all-the-bells-and-whistles, fully-customized accounting applications? They are all based on the system of Double Entry Bookkeeping developed in Venice during the Renaissance. First written of by Franciscan Friar Luca Pacioli it has been in use since the fifteenth century at least and may be even older.

The system of double entry bookkeeping relies on two foundational rules:

- Every entry maintains the balance of the fundamental accounting equation (FAE). Namely that Total Assets = Total Liabilities + Total Shareholder’s Equity

- That every entry will change the balance in at least two accounts (hence the “double” in double entry bookkeeping)

Types of Accounts

If you’re completely new to accounting and bookkeeping you may need a bit of a primer. At the most fundamental level we have only two types of accounts: temporary and permanent.

Temporary accounts, also called Income Statement accounts, appear on the Income Statement (a.k.a. the Statement of Profit and Loss). They are called temporary accounts because they track balances during the accounting period (usually one year) and are reset to zero at year-end and start all over again for the new year. The Income Statement displays at least two and as many as four different types of temporary accounts: Revenue (sales), Expenses (including cost of goods sold), Gains (if any) and Losses (if any).

Permanent accounts, also called Balance Sheet accounts, appear on the Balance Sheet (a.k.a. the Statement of Financial Position). They are called permanent accounts because they track balances which do not reset at the end of the fiscal year. Their balances are continuous in time, or permanent, and are adjusted by transactions only and never intentionally reset at a point in time. The Balance Sheet displays three types of permanent accounts: Assets (what the company owns or controls), Liabilities (what the company owes through bills, debts and other obligations) and Shareholders’ Equity (funds invested by shareholders and accumulated profits less distributions of those profits). All accounts on the Income Statement are reset at year end and Net Income is transferred to the Shareholder’s Equity portion of the Balance Sheet. In this way everything in the Income Statement is represented on the Balance Sheet.

Adding Transactions

The job of the accounting team is to record what happens throughout the year to ensure that they can report accurate balances for each of the 7 types of accounts listed above (4 temporary plus 3 permanent). This is done by recording every transaction that the company executes. A transaction occurs when there is an exchange between the company and an outside party and does not necessarily involve cash. Each one of these transactions will affect at least two accounts. Here’s an example:

Let’s say your company provides services. You do the work and then bill your client. The client pays you within 30 days. When do transactions occur and what should the entries be?

- You’ve finished doing the work and are ready to bill the client. When you enter the invoice you will be increasing your Revenue total for the year by the amount of the invoice. You will also be increasing your Accounts Receivable (Trade Receivable) balance by the value of the invoice. You will keep the FAE in balance because Total Assets and Total Shareholder’s Equity will increase by the same amount.

- The client pays this invoice. When you record the payment you will increase your Cash balance because you’ve been paid. You will simultaneously decrease your Accounts Receivable balance because this invoice is no longer outstanding. The FAE will stay in balance because you are increasing the value of one asset (Cash) and decreasing the value of another asset (Accounts Receivable) so the Total Asset balance will remain unchanged.

Before computers it was possible for entities to track their financial performance and keep track of all of their balances using this method with nothing but pen and paper (or quill and parchment?). The entries were known as Journal Entries which were added to the General Ledger (GL). The GL was a record of all transactions and was used to compute balances and generate financial statements.

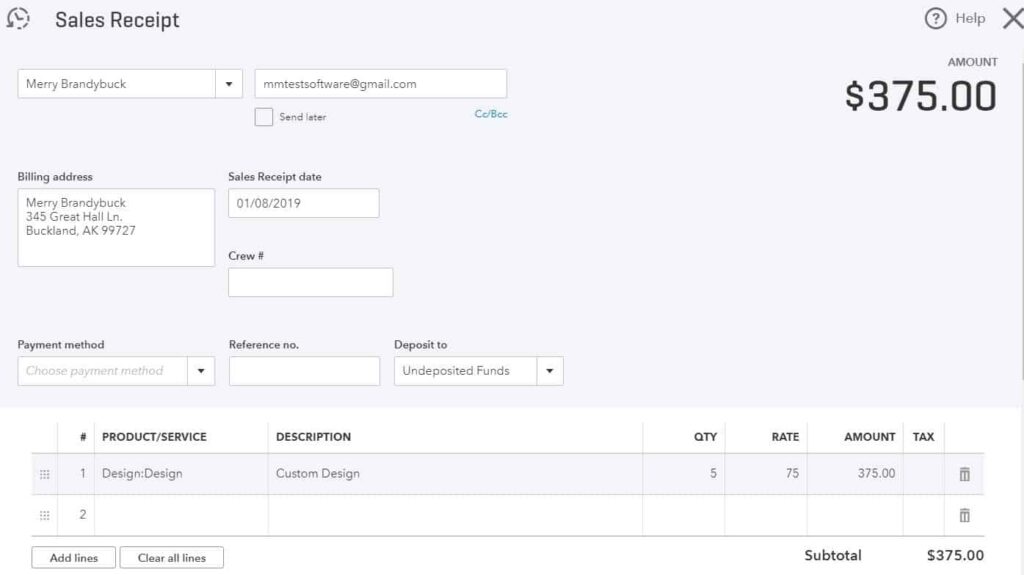

Once accounting systems became computerized there was an added benefit to this system: database creation. By creating form entry screens which simplified data entry (ex. Invoices, Sales Receipts, Bills) the user could not only track financial statement balances but could also create a database of names, addresses, product sales and more. But at the back of all of this added functionality the same core double-entry bookkeeping concept is used. If you can understand this concept then you will be able to use any kind of accounting program – it will only be a matter of figuring out where to click.

Journal Entries vs. Forms

The Journal Entry screen serves as a type of “manual override” in accounting systems. It can be used to enter any transaction into the system in the same way those Renaissance merchants used to centuries ago. But because there are fewer user controls to protect you against an incorrect entry the risk for errors increases.

So should you use Journal Entries in your bookkeeping? Not if you can help it. Journal Entries have their place in modern accounting but you’re foregoing the additional data which is captured when you use the correct entry form. Additionally, you’re exposing yourself to an increased risk of error, threatening the integrity of your accounting data. Regular transactions should be entered using the various forms (invoice, payment, sales receipt, bill, bill payment, expense, transfer, etc.). Refer irregular transactions to your accountant; they may recommend a journal entry but then you can rely on its accuracy, suitability and correctness.

So by using the forms are we guaranteed to have an accurate set of accounting records? No, not necessarily. It’s possible to mess up using the form entries by not understanding the impact of each of your line entries or items. Remember, in double entry bookkeeping you are always affecting at least one other account. If you’re entering a bill you just received you’re correctly increasing the Accounts Payable balance but you may be categorizing the expense incorrectly on the line item. Some accounting programs allow you to post bills to account types other than expenses (liabilities, asset or revenue). Or for another example, using an incorrectly set up product in your invoice entry can post the account to the wrong sales account. These types of errors can lead to incorrect entries, and subsequently incorrect data and incorrect reports. “Garbage in, garbage out,” as they say.

Preventing Errors

By using the system of double entry bookkeeping we can keep track of our accounting data accurately. But we risk errors if data is entered incorrectly. Every entry must be balanced, having one side (the one you’re thinking about when you make the entry) and a balancing side or “offset” that you may not have considered.

Whenever you’re making entries remember to ask yourself: “What is the other side of this entry?” This simple step can save you headaches down the road and will help you understand your entries and accounting records more intimately. For example, if you’re posting bills make sure they are being categorized to the correct expense and the sales tax is being accounted for (you get a reduction to your HST in Ontario for HST paid to suppliers so it’s important that these entries also reduce your HST payable liability and prevent you from overpaying). Therefore, you need to split the transaction into its components and make sure you are adjusting the 3 correct balances (Accounts Payable, HST Payable, and the Appropriate Expense).

Double-entry bookkeeping is the ingenious system by which we efficiently document our transactions, maintain our General Ledger, and permit the production of reports and Financial Statements. It has a level of complexity but it isn’t voodoo, magic or rocket science. Now that you understand it a bit better, take a minute to review some of your transactions and see the accounts that are affected in each transaction. You may even be able to spot some errors to fix!

If reading about this time-tested, universal system of bookkeeping has made your eyes glaze over, not to worry. At Toronto Bookkeeping Plus we can perform all of your bookkeeping remotely and reliably. If you’ve had it with doing your bookkeeping yourself then contact us today for your free consultation. We also provide training for bookkeepers that is customized to your company’s accounting cycle platform and configuration. If you or your staff just need a little extra help before carrying on this can be great option with lasting value. Request your free quote today!

Previous Topic: What is bookkeeping?

Next Topic: Generating Automated Reports